MercoPress. South Atlantic News Agency

United States

-

Friday, August 1st 2014 - 08:33 UTC

US calls on Argentine government to seek 'practical solutions' with holdouts

Kevin Sullivan, US interim ambassador in Argentina affirmed on Thursday that the country must seek “practical solutions” with the 'holdouts' or the so called vulture funds over defaulted bonds.

-

Friday, August 1st 2014 - 07:57 UTC

World economists call on US Congress to take action on the Argentina/holdouts rulings

Over 100 economists, including Nobel laureate Robert Solow, Branko Milanovic and Dani Rodrik called on the United States Congress to take action to mitigate the harmful fallout from the recent ruling by Judge Griesa of the U.S. District Court for the Southern District of New York that requires Argentina to pay holdout creditors at the same time as the majority of creditors.

-

Friday, August 1st 2014 - 07:52 UTC

Argentine president defies Judge Griesa rulings and mocks 'selective default'

President Cristina Fernández said on Thursday she will not “sign an agreement” that compromises Argentina's future, while blasting “vulture funds” for wanting to “collect Griesa's usurious sentence”, following the Wednesday failure of negotiations between the country and holdouts.

-

Friday, August 1st 2014 - 02:43 UTC

Saying Argentina has defaulted is “an atomic nonsense” underlines Kicillof

Argentina's Economy Minister Axel Kicillof denied point blank that Argentina defaulted on its debt and described such statement as “an atomic nonsense”. The minister gave a press conference in Buenos Aires a day after the failed negotiations with holdouts in New York and claimed ”those who today cheer the apocalypse, applauded the 2001 (crisis).”

-

Thursday, July 31st 2014 - 22:10 UTC

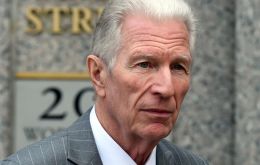

Judge Griesa summons Argentina and holdouts for a Friday hearing

After negotiations between the Argentine government and the speculative funds, led by US Special Master Daniel Pollack failed, New York District Judge Thomas Griesa called for a new hearing between the parties for Friday at 12 pm (Argentina time).

-

Thursday, July 31st 2014 - 07:29 UTC

US imposes travel restriction on a number of Venezuelan officials

The United States is imposing travel restrictions on a number of Venezuelan officials. Washington did not specify how many people would be affected, but said those “who have been responsible for or complicit in human rights abuses” would not be “welcome” in the US.

-

Thursday, July 31st 2014 - 07:13 UTC

Fed further tapers bond-buying program but concerned with labor market

The Federal Reserve said on Wednesday that US growth in economic activity rebounded in the second quarter and labor market conditions improved, with the unemployment rate declining further. However, a range of labor market indicators suggests that there remains significant “underutilization of labor resources”.

-

Thursday, July 31st 2014 - 07:05 UTC

Kicillof blames Judge Griesa for the 'no-deal' situation with holdouts

Argentina failed to strike a deal to avert its second default in more than 12 years after talks with holdout creditors and special mediator Daniel Pollack ended without a settlement on Wednesday.

-

Thursday, July 31st 2014 - 06:55 UTC

Argentine private banks discussing bond purchase from holdouts

The meeting between Argentine private bank representatives and the 'holdouts' over the debt held by the hedge funds has been adjourned and will be resumed on Thursday, according to Buenos Aires financial daily Ambito.com.

-

Thursday, July 31st 2014 - 01:15 UTC

“Argentina will imminently be in default: no agreement was reached”, said Pollack

“Unfortunately no agreement was reached and Argentina will imminently be in default”, admitted Daniel A. Pollack, the Special Master appointed by Judge Thomas P. Griesa to conduct and preside over settlement negotiations between Argentina and its holdout bondholders. Pollack emphasized that with default “the ordinary Argentine citizen will be the real and ultimate victim”.