MercoPress. South Atlantic News Agency

China/Argentina closer links; Beijing to finance the country's fourth nuclear power plant

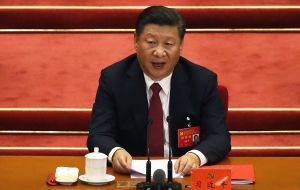

Argentina hopes to announce a deal on the Chinese-financed construction of the Atucha III nuclear power plant during Chinese President Xi Jinping’s state visit

Argentina hopes to announce a deal on the Chinese-financed construction of the Atucha III nuclear power plant during Chinese President Xi Jinping’s state visit  China has emerged as Argentina’s critical trading partner, investor and financier, with Beijing pumping billions into Argentina’s economy and reliable lender.Xi Jinping is expected to arrive in the co

China has emerged as Argentina’s critical trading partner, investor and financier, with Beijing pumping billions into Argentina’s economy and reliable lender.Xi Jinping is expected to arrive in the co Argentina and China are aiming to close a deal within days for the construction of the country's fourth nuclear power plant, a multi-billion dollar project that would cement Beijing’s deepening influence in a key regional U.S. ally.

Argentina hopes to announce an agreement on the Chinese-financed construction of the Atucha III nuclear power plant during Chinese President Xi Jinping’s state visit on Sunday following the summit of leaders of G20 industrialized nations in Buenos Aires, Juan Pablo Tripodi, head of Argentina’s national investment agency, announced.

The potential deal, reportedly worth up to US$8 billion, is emblematic of China’s strengthening of economic, diplomatic and cultural ties with Argentina. It is part of a wider push by Beijing into Latin America that has alarmed the United States, which views the region as its backyard and is suspicious of China’s motives.

The focus of this week’s meeting between U.S. President Donald Trump and his Chinese counterpart Xi Jinping on the sidelines of G20 will be on their two countries’ trade war, but the backdrop will be the competition between the powers for influence in Latin America.

When Argentina negotiated a US$ 56.3 billion financing deal with the IMF to rescue its troubled economy earlier this year, Trump voiced his support for the plan and President Mauricio Macri’s leadership.

But it is China that has emerged as Argentina’s critical trading partner, investor and financier, with Beijing pumping billions into Argentina’s economy and positioning itself as a reliable lender for its crisis-stricken economy.

China and Argentina are expected to seal a currency swap deal this weekend that doubles the original amount of the credit line to US$ 18.7 billion. The deal will make China the biggest non-institutional lender to Argentina.

China is the main importer of Argentine soybeans. In the last 10 years, it has also emerged as a major financier of Argentine projects, mainly infrastructure, worth a total of about US$ 18 billion, offering low interest rates of between 3 and 4%, according to a Reuters review of Chinese state funding data compiled by the Inter-American Dialogue, a Washington-based non-profit think-tank.

Argentina’s national newspaper Clarin reported at the weekend that if the deal was signed, China would loan Argentina US$ 6.5 billion to be repaid in 20 years, with eight years of grace and a 4.5% annual interest.

Defending Argentina’s relationship with China, an Argentine government official told Reuters that Beijing was an important investor and would only become more important in the future. However, the official acknowledged the U.S. concerns were not without merit.

“Overall, I would say it’s a fair warning and it’s something countries should take into consideration. I think Argentina takes it into consideration very seriously,” the official said.

China’s attraction to Argentina can be attributed to three factors: natural resources, weak institutions, and the country’s lack of other financing options, according to Juan Uriburu, an Argentine lawyer who has worked on two major Argentina-China joint ventures.

As a presidential candidate, Macri pledged to recalibrate Argentina’s relationship with China. Under his predecessor, Cristina Fernandez, Argentina had changed the law to enable Chinese companies to skip the bidding process if they were financing projects, according to Margaret Myers, director of the China and Latin American program at Inter-American Dialogue.

When Macri took office in late 2015, he vowed to review deals the Fernandez government had made with China. Atucha III, a railway project and two hydropower dams in Santa Cruz province, which her late husband had governed, were among projects thrown into limbo.

Cross-cancellation clauses, however, have made it difficult for Macri to terminate the largest projects, said Uriburu. Macri has instead renegotiated some terms, including bringing down the loan amount for the hydro dams from US$ 4.7 billion to US$4 billion.

China’s influence in Argentina extends beyond the numbers. For example, it has established Confucius institutes, cultural organizations, at Argentina’s largest university, the University of Buenos Aires, and a second college in Buenos Aires province.

Top Comments

Disclaimer & comment rulesCommenting for this story is now closed.

If you have a Facebook account, become a fan and comment on our Facebook Page!