MercoPress. South Atlantic News Agency

Economy

-

Thursday, July 31st 2014 - 22:10 UTC

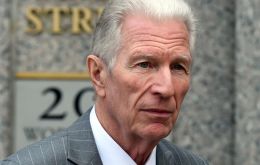

Judge Griesa summons Argentina and holdouts for a Friday hearing

After negotiations between the Argentine government and the speculative funds, led by US Special Master Daniel Pollack failed, New York District Judge Thomas Griesa called for a new hearing between the parties for Friday at 12 pm (Argentina time).

-

Thursday, July 31st 2014 - 07:13 UTC

Fed further tapers bond-buying program but concerned with labor market

The Federal Reserve said on Wednesday that US growth in economic activity rebounded in the second quarter and labor market conditions improved, with the unemployment rate declining further. However, a range of labor market indicators suggests that there remains significant “underutilization of labor resources”.

-

Thursday, July 31st 2014 - 07:05 UTC

Kicillof blames Judge Griesa for the 'no-deal' situation with holdouts

Argentina failed to strike a deal to avert its second default in more than 12 years after talks with holdout creditors and special mediator Daniel Pollack ended without a settlement on Wednesday.

-

Thursday, July 31st 2014 - 06:55 UTC

Argentine private banks discussing bond purchase from holdouts

The meeting between Argentine private bank representatives and the 'holdouts' over the debt held by the hedge funds has been adjourned and will be resumed on Thursday, according to Buenos Aires financial daily Ambito.com.

-

Thursday, July 31st 2014 - 01:15 UTC

“Argentina will imminently be in default: no agreement was reached”, said Pollack

“Unfortunately no agreement was reached and Argentina will imminently be in default”, admitted Daniel A. Pollack, the Special Master appointed by Judge Thomas P. Griesa to conduct and preside over settlement negotiations between Argentina and its holdout bondholders. Pollack emphasized that with default “the ordinary Argentine citizen will be the real and ultimate victim”.

-

Wednesday, July 30th 2014 - 08:02 UTC

Argentine private banks prepared to buy holdouts' credit; Kicillof/Pollack talks to continue today

“Special Master” Daniel Pollack, the mediator appointed by US judge Griesa to resolve the dispute between Argentina and the speculative funds' holdouts said the parts talked “face to face” for the first time and assured a new meeting will be confirmed during the day. If a deal is not reached Wednesday sunset Argentina could again fall into default.

-

Wednesday, July 30th 2014 - 08:01 UTC

Japan's PM Abe at CARICOM summit pledges development support

Heads of Government of the fourteen Caribbean Community (CARICOM) “were heartened” by their Japanese counterpart’s Shinzo Abe positive response to a number of issues raised during their one-day summit in Guyana.

-

Wednesday, July 30th 2014 - 07:45 UTC

UK and US fine Lloyds group £218m for manipulating the Libor rate

Lloyds Banking Group has been fined £218m for “serious misconduct” over some key interest rates set in London. The group manipulated the London interbank offered rate (Libor) for yen and sterling and tried to rig the rate for yen, sterling and the US dollar, said the US legal order.

-

Wednesday, July 30th 2014 - 07:23 UTC

IMF warning on interest rates and Russian crisis for some EU banks

Sharply higher interest rates around the world could combine with weaker growth in emerging markets to slice as much as two percentage points off global growth in the next five years, the International Monetary Fund said on Tuesday.

-

Wednesday, July 30th 2014 - 07:10 UTC

Cristina Fernandez thanks Mercosur support and again attacked Judge Griesa

President Cristina Fernández addressed fellow heads of state at the Mercosur summit in Caracas, where she thanked members of the bloc for their support over the ongoing fight with holdout investors in the New York courts and underlined that Argentina “has paid debt obligations religiously”.