MercoPress. South Atlantic News Agency

Tag: Argentina default

-

Saturday, August 2nd 2014 - 08:58 UTC

Argentina suggests Griesa and Pollack are actively helping holdouts by declaring a 'default'

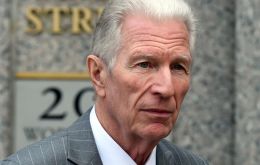

The Argentine Economy Ministry claimed on Friday New York judge Thomas Griesa has benefited “vulture funds” during negotiations over Argentina's defaulted debt with holdouts and asked the (Argentine) National Values Commission (CNV) to start an investigation over alleged “speculative moves”.

-

Saturday, August 2nd 2014 - 08:46 UTC

Brazilian media call Cristina Fernandez, “inept, arrogant and incompetent”

The leading Brazilian newspapers blasted Argentine president Cristina Fernandez as the sole responsible for the 'default event' which followed the failure of negotiations with holdouts in New York. This despite the fact Brazilian economy minister Guido Mantega denied Argentina was in default and strongly supported the Argentine government.

-

Friday, August 1st 2014 - 07:57 UTC

World economists call on US Congress to take action on the Argentina/holdouts rulings

Over 100 economists, including Nobel laureate Robert Solow, Branko Milanovic and Dani Rodrik called on the United States Congress to take action to mitigate the harmful fallout from the recent ruling by Judge Griesa of the U.S. District Court for the Southern District of New York that requires Argentina to pay holdout creditors at the same time as the majority of creditors.

-

Friday, August 1st 2014 - 07:52 UTC

Argentine president defies Judge Griesa rulings and mocks 'selective default'

President Cristina Fernández said on Thursday she will not “sign an agreement” that compromises Argentina's future, while blasting “vulture funds” for wanting to “collect Griesa's usurious sentence”, following the Wednesday failure of negotiations between the country and holdouts.

-

Friday, August 1st 2014 - 02:43 UTC

Saying Argentina has defaulted is “an atomic nonsense” underlines Kicillof

Argentina's Economy Minister Axel Kicillof denied point blank that Argentina defaulted on its debt and described such statement as “an atomic nonsense”. The minister gave a press conference in Buenos Aires a day after the failed negotiations with holdouts in New York and claimed ”those who today cheer the apocalypse, applauded the 2001 (crisis).”

-

Thursday, July 31st 2014 - 07:05 UTC

Kicillof blames Judge Griesa for the 'no-deal' situation with holdouts

Argentina failed to strike a deal to avert its second default in more than 12 years after talks with holdout creditors and special mediator Daniel Pollack ended without a settlement on Wednesday.

-

Thursday, July 31st 2014 - 06:55 UTC

Argentine private banks discussing bond purchase from holdouts

The meeting between Argentine private bank representatives and the 'holdouts' over the debt held by the hedge funds has been adjourned and will be resumed on Thursday, according to Buenos Aires financial daily Ambito.com.

-

Thursday, July 31st 2014 - 01:15 UTC

“Argentina will imminently be in default: no agreement was reached”, said Pollack

“Unfortunately no agreement was reached and Argentina will imminently be in default”, admitted Daniel A. Pollack, the Special Master appointed by Judge Thomas P. Griesa to conduct and preside over settlement negotiations between Argentina and its holdout bondholders. Pollack emphasized that with default “the ordinary Argentine citizen will be the real and ultimate victim”.

-

Wednesday, July 30th 2014 - 08:02 UTC

Argentine private banks prepared to buy holdouts' credit; Kicillof/Pollack talks to continue today

“Special Master” Daniel Pollack, the mediator appointed by US judge Griesa to resolve the dispute between Argentina and the speculative funds' holdouts said the parts talked “face to face” for the first time and assured a new meeting will be confirmed during the day. If a deal is not reached Wednesday sunset Argentina could again fall into default.

-

Tuesday, July 29th 2014 - 05:35 UTC

“ Argentina Dances With Default”, warns The Wall Street Journal

As Argentina approached the deadline for another default, second in twelve years, the governments of President Cristina Fernandez is trashing a U.S. judge rather than repay creditors, underlines an editorial column from The Wall Street Journal.