MercoPress. South Atlantic News Agency

Tag: China

-

Monday, November 23rd 2015 - 10:42 UTC

Unfair to claim China sparked a 'currency war', argues India's central bank

”It’s unfair to pin the blame on the August 11 Yuan devaluation because currencies were already declining due to the “unconventional monetary policies” of some nations, Raghuram Rajan was cited as saying in an interview with the SCMP.

-

Monday, November 23rd 2015 - 09:39 UTC

China's Yuan to be included in IMF's SDR basket of currencies

The inclusion of the Chinese currency in the International Monetary Fund's special drawing rights (SDR) basket is long awaited, long overdue and, finally, all but a foregone conclusion.

-

Monday, November 23rd 2015 - 08:46 UTC

China cracks on 'underground banks' to combat corruption and capital outflows

China said it cracked the nation’s biggest “underground bank,” which handled 410 billion Yuan (USD64 billion) of illegal foreign-exchange transactions, as the authorities try to combat corruption and rein in capital outflows that have hit records this year.

-

Tuesday, November 17th 2015 - 08:54 UTC

Two Chinese nuclear plants for Argentina in a 15bn dollars deal

Argentina signed two nuclear power plant construction deals with China on Sunday worth around US$15 billion, which would add 1,750 megawatts to the energy already produced by the country's three nuclear power plants.

-

Tuesday, November 10th 2015 - 08:00 UTC

China imports drop for twelfth month running: 18.8% in October

China saw imports drop for the twelfth month in a row in October giving further cause for concern over the Chinese economy. Imports by the world's biggest trader of goods fell 18.8% from a year earlier to $130.8bn, a slight improvement on September's 20.4% decline.

-

Thursday, November 5th 2015 - 07:30 UTC

Beijing and Taiwan leaders to meet for the first time in 66 years, in Singapore

Just weeks before Taiwan holds general and presidential elections, Taiwan President Ma Ying-jeou announced he will hold face-to-face talks with Chinese leader Xi Jinping in Singapore. The meeting Saturday will be the first between Taiwanese and Chinese leaders since 1949 and authorities in China are predicting it will be a “major historic milestone” in the development of cross-strait relations.

-

Tuesday, November 3rd 2015 - 12:38 UTC

Chinese manufacturing contracts for third month running

Chinese manufacturing has contracted for the third month in a row, according to the government's latest factory survey. The Purchasing Managers' Index (PMI) showed a reading of 49.8 for October, unchanged from last month. A figure below 50 indicates that factory activity contracted.

-

Monday, November 2nd 2015 - 09:18 UTC

China's Renmimbi has become world's second most used currency in trade finance

As China establishes itself as the world’s second largest economy and top trading nation, its currency, the renminbi (RMB), is also gaining popularity around the world. According to the People’s Bank of China’s 2015 Renminbi Internationalization Report, the RMB was the world’s 5th most used payment currency, the 2nd most used trade finance currency, and the 6th most traded currency in 2014.

-

Friday, October 30th 2015 - 07:48 UTC

Chinese couples allowed to have a second child; policy was imposed in 1979 to slow population growth

China has decided to end its decades-long one-child policy, the state-run Xinhua news agency reports. Couples will now be allowed to have two children, it said, citing a statement from the Communist Party. The controversial policy was introduced nationally in 1979, to slow the population growth rate.

-

Wednesday, October 28th 2015 - 08:41 UTC

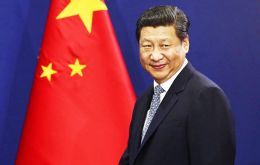

The defense of the Falklands must take centre stage in Anglo-Chinese relations

By Alex Calvo (*) - Chinese Leader Xi Jinping’s state visit to the United Kingdom has been met with grand-sounding headlines, including references to a “golden era”. Public statements by both governments have focused on growing economic links, while some voices referred to human rights and US commentators expressed their concern at London’s closeness to Beijing at a time of increased tensions in the Indo-Pacific, above all the South China Sea.