MercoPress. South Atlantic News Agency

Tag: global trade

-

Monday, October 8th 2018 - 08:39 UTC

Canada chairs meeting to reform WTO, but has not invited US or China

Canada has not invited the United States or China to a high-level meeting on reforming the World Trade Organization (WTO). The country will host a “small group of like-minded” trade ministers in Ottawa in late October to discuss the global trade body. Officials say countries like the US and China will be included at a later date in the reforms discussion process.

-

Wednesday, June 20th 2018 - 08:31 UTC

Global Index decides on Wednesday if it includes Argentina and Saudi Arabia

Global index compiler MSCI is considering including Argentina and Saudi Arabia in its emerging market indexes at a review of its widely-tracked benchmark on Wednesday, and could potentially announce candidates that may join its indexes in future.

-

Tuesday, March 27th 2018 - 09:42 UTC

The World's Biggest Investors Have Lost $436 Billion In 2018

Wall Street is shocked, but it shouldn't be: Tariffs targeting China should have been a given, and now the market's tanking on trade war fears as if it just crept up on everyone, but Trump's been very clear on this.

-

Wednesday, March 21st 2018 - 10:03 UTC

Financial leaders reject protectionism, but prepare for a trade war

The world’s financial leaders rejected protectionism on Tuesday and urged “further dialogue” on trade, but failed to diffuse the threat of a trade war days before U.S. metals tariffs take effect and Washington is to announce measures against China. Finance ministers and central bankers of the world’s 20 biggest economies, which represent 75% of world trade and 85% of global gross domestic product, discussed trade disruptions as a risk to growth at a two-day meeting.

-

Friday, March 9th 2018 - 09:34 UTC

Eleven Asia-Pacific countries signed a Trans-Pacific Partnership in Chile

Eleven Asia-Pacific countries have just signed the trade pact formerly known as the Trans-Pacific Partnership. Although the US pulled out last year, the deal was salvaged by the remaining members, who signed it at a ceremony in the Chilean city of Santiago.

-

Tuesday, January 23rd 2018 - 09:23 UTC

Trump's tax reform prompts brighter outlook for global economy, says IMF

Prospects for the global economy are looking brighter, according to the International Monetary Fund (IMF), arguing that the recent pick-up has been pretty broad-based, particularly in Europe and Asia. Tax reforms in the United States are expected to stimulate economic activity, especially business investment.

-

Tuesday, January 23rd 2018 - 09:08 UTC

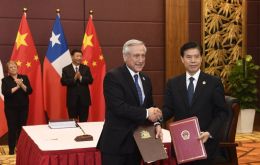

Chile praises Beijing for its leadership and rejecting protectionism

Chile’s foreign minister welcomed Chinese representatives to a meeting with Latin American and Caribbean countries and praised Beijing for rejecting protectionism as the United States backs away from global trade.

-

Thursday, January 17th 2013 - 08:26 UTC

World Bank says global economy remains fragile: forecasts GDP growth at 2.4%

Four years after the onset of the global financial crisis, the worst appears to be over. However, the global economy remains fragile, as high-income countries continue to suffer from volatility and slow growth, says the World Bank’s latest Global Economic Prospects, issued on Wednesday.