MercoPress. South Atlantic News Agency

Tag: NML Capital Limited

-

Thursday, September 11th 2014 - 04:48 UTC

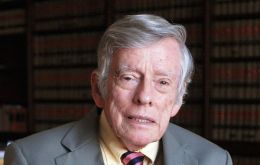

Judge Griesa will wait for appeals court ruling before acting on holdouts' Citibank subpoena

US district judge Thomas Griesa has said he would wait for a decision on a pending appeal before ordering Citigroup to comply with a subpoena served by holdout investors seeking details of any threats from Argentina to process payments the court had blocked.

-

Friday, August 29th 2014 - 05:56 UTC

Argentina will only negotiate with all bondholders: no more piecemeal debt talks

Argentina's government ruled out further piecemeal debt talks with a small group of U.S. hedge funds (holdouts) and said the country needed to strike a deal with all bondholders including those which have rejected past restructuring agreements as a single group.

-

Friday, August 22nd 2014 - 07:17 UTC

Griesa leaves Argentina 'in contempt' ledge; warns any change of jurisdiction was 'lawless'

US District Judge Thomas Griesa declared on Thursday that an Argentine plan to change the 'jurisdiction' of restructured foreign debt was illegal, while resisting holdout investors' demands that Argentina be held in contempt of court for attempting to change the site of payment to Buenos Aires.

-

Thursday, August 21st 2014 - 07:07 UTC

Aurelius Capital brands Argentine leaders 'outlaws' for flouting US courts orders

One of two hedge funds that sued Argentina over defaulted bonds branded the country's leaders “outlaws” on Wednesday after Buenos Aires moved to shift its bond payment method.

-

Thursday, August 14th 2014 - 06:34 UTC

Talks between global banks and Argentine creditor hedge fund “collapsed”

Talks between a group of global banks and at least one major hedge fund about buying a portion of the fund's exposure to Argentine debt have collapsed, a person familiar with the matter told sources in Buenos Aires, amid concerns that the Argentine government has dug in to its refusal to pay certain creditors what they are owed and may not relent for months to come.

-

Wednesday, August 13th 2014 - 06:57 UTC

“Homeland or Vultures” militants rally in support of Cristina Fernandez

Thousands of Argentine pro government activists gathered at the Luna Park stadium in Buenos Aires City, to express their support in favor of President Cristina Fernández stand against the so called holdouts (or 'vulture funds') as well as her continuity at the head of the Kirchnerite project.

-

Saturday, August 9th 2014 - 07:34 UTC

Griesa warns Argentina with 'contempt' if it continues with “false and deceiving statements”

New York district judge Thomas Griesa on Friday threatened to declare Argentina in “contempt” of court if the Republic continues to make “false and deceiving statements,” following Argentina’s claim it has already paid exchange bondholders and has no pending obligations, as it deposited 539 million dollars in bond payments in Bank of New York Mellon (BoNY) and Citibank.

-

Tuesday, August 5th 2014 - 06:54 UTC

Griesa praises Pollack's 'great skill” and reveals he directed the use of 'default'

U.S. District Judge Thomas Griesa on Monday turned back an effort by Argentina's government to remove the court-appointed mediator in the dispute with creditors that triggered a 'selective default' situation by the country last week. He also revealed that the default condition was at his direction and was 'accurate'.

-

Thursday, July 31st 2014 - 07:05 UTC

Kicillof blames Judge Griesa for the 'no-deal' situation with holdouts

Argentina failed to strike a deal to avert its second default in more than 12 years after talks with holdout creditors and special mediator Daniel Pollack ended without a settlement on Wednesday.

-

Wednesday, July 30th 2014 - 08:02 UTC

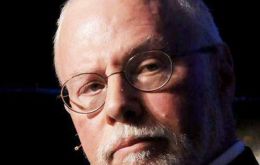

Argentine private banks prepared to buy holdouts' credit; Kicillof/Pollack talks to continue today

“Special Master” Daniel Pollack, the mediator appointed by US judge Griesa to resolve the dispute between Argentina and the speculative funds' holdouts said the parts talked “face to face” for the first time and assured a new meeting will be confirmed during the day. If a deal is not reached Wednesday sunset Argentina could again fall into default.