MercoPress. South Atlantic News Agency

Tag: NML Capital Limited

-

Tuesday, April 7th 2015 - 07:46 UTC

Argentina appeals to Judge Griesa bar on Citibank to process bonds under local law

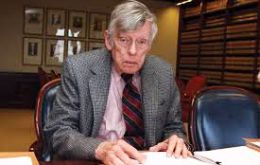

Argentina has formally appealed to the New York justice system the ruling handed down by district judge Thomas Griesa, which barred intermediary Citibank from processing US dollar denominated debt services issued under Argentine law and which expired on March 31.

-

Thursday, March 26th 2015 - 08:22 UTC

Griesa blocks Euroclear from processing any Argentina bonds payments

New York judge Thomas Griesa on Wednesday barred Euroclear, the giant Belgium-based financial clearing and settlement house, from processing any debt payments by Argentina. In the newest step tightening Buenos Aires' avenues for avoiding paying off hedge funds on their bonds, Griesa forbade Euroclear from processing “any payments received from any source” in respect to Argentine bonds.

-

Wednesday, March 25th 2015 - 07:30 UTC

New York Court of Appeals delays decision on Argentina's contempt of court

The New York Court of Appeals has decided to push back its decision on Argentina for another week, as the Cristina Fernandez administration seeks to overturn the contempt ruling imposed by judge Thomas Griesa in the ongoing conflict against holdout investors.

-

Tuesday, March 24th 2015 - 05:16 UTC

Holdouts of Argentine-law bonds 'reach agreement' with Griesa and Citibank

Paul Singer-controlled NML Capital said that the hedge fund, as well as other holders of Argentine debt, made a deal with Citibank regarding the legal dispute at New York courts over Argentine-law bonds.

-

Friday, March 13th 2015 - 11:18 UTC

Griesa blocks Citigroup from paying interest on Argentine bonds; group will appeal

A United States federal judge on Thursday said Citigroup Inc cannot process interest payments by Argentina on some bonds issued under that country's law. U.S. District Judge Thomas Griesa in Manhattan said letting Citigroup process the payments on so-called dollar-denominated exchange bonds would violate a requirement that Argentina treat bondholders equally.

-

Wednesday, February 25th 2015 - 05:27 UTC

Argentina will appeal on Thursday Judge Griesa's 'contempt of court'

The Argentine government will present on Thursday its appellant’s brief over the contempt of court ordered by New York Judge Thomas Griesa, the Economy Ministry has confirmed. Griesa had ruled Argentina in contempt of his orders due to working on a plan to shift control over payments of its restructured debt to Buenos Aires.

-

Thursday, December 11th 2014 - 11:29 UTC

Argentine argues before NY Appeals court the central bank is not an 'alter ego' of the administration

Lawyers representing the Argentine government and the Central Bank have defended the country's stance on the debt conflict in a hearing with the New York Second Circuit Appeals Court, rejecting the notion that holdout investors could confiscate reserves or assets belonging to the financial entity.

-

Tuesday, November 11th 2014 - 07:25 UTC

Griesa authorizes Citibank to pay restructured bonds under Argentine law

New York District judge Thomas Griesa has authorized Citibank to complete the transfer of 85 million dollars to holders of restructured Argentine bonds under Argentine law, meeting debt services that expire on December 31.

-

Sunday, November 9th 2014 - 10:35 UTC

Argentine bondholders file for 'me too' at Judge Griesa's court: claims reach 6.5bn

Argentina told New York district judge Thomas Griesa that bondholders filed 25 lawsuits since June, when the judge ordered blocking the country's from paying its restructured debt without also paying a group of holdouts, Bloomberg news has reported.

-

Friday, November 7th 2014 - 23:08 UTC

English court involved in Argentine bonds dispute with hedge funds

A London court gave Argentine “holdout creditors” in New York a two-week window on Thursday to challenge declarations sought by a powerful group of investors in a dispute over interest payments worth about 226 million Euros. The payments involve Euro-denominated Argentine bonds which were issued under English law.