MercoPress. South Atlantic News Agency

Tag: OPEC

-

Wednesday, January 14th 2015 - 07:47 UTC

OPEC member stands by group's decision not to cut output to tackle glut

Brent and US WTI crude oil prices fell to their lowest levels in almost six years on Tuesday as a big OPEC producer stood by the group's decision not to cut output to tackle a glut in the market.

-

Tuesday, January 13th 2015 - 08:56 UTC

The real cause of low oil prices: Interview with Arthur Berman

With all the conspiracy theories surrounding OPEC's November decision not cut production, is it really not just a case of simple economics? The U.S. shale boom has seen huge hype but the numbers speak for themselves and such overflowing optimism may have been unwarranted. When discussing harsh truths in energy, no sector is in greater need of a reality check than renewable energy.

-

Tuesday, January 13th 2015 - 07:39 UTC

Goldman Sachs forecasts oil price close to 40 dollars for most of fist half of 2015

The price of a barrel of the North Sea benchmark dropped on Monday by 5.5% to 47.36 dollars, its lowest level since early 2009. US crude oil was also at its lowest level since that time, down by 5% to 45.90 a barrel.

-

Thursday, January 8th 2015 - 05:34 UTC

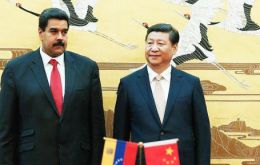

Maduro announces 20bn dollars in investment credits from China

President Nicolas Maduro said on Wednesday he had secured a total of more than 20 billion dollars in investment from major creditor China for economic, social, and oil-related projects.

-

Tuesday, January 6th 2015 - 23:11 UTC

Energy crisis as early as 2016

Low oil prices today may be setting the world up for an oil shortage as early as 2016. Today we have just 2% more crude oil supply than demand and the price of gasoline is under $2.00/gallon in Texas. If oil supply falls too far, we could see gasoline prices doubling within 18 months. For a commodity as critical to our standard of living as oil is, it only takes a small shortage to drive up the price.

-

Tuesday, January 6th 2015 - 07:41 UTC

US oil price falls below 50 dollars threshold, and markets decline sharply

The US oil price fell below the symbolic threshold of $50 a barrel for the first time since April 2009, before finishing the day at $50.05. The price of Brent crude also fell on Monday, dipping 6% to $53 a barrel.

-

Monday, December 29th 2014 - 20:09 UTC

Did The Saudis And The US Collude In Dropping Oil Prices?

The oil price drop that has dominated the headlines in recent weeks has been framed almost exclusively in terms of oil market economics, with most media outlets blaming Saudi Arabia, through its OPEC Trojan horse, for driving down the price, thus causing serious damage to the world's major oil exporters – most notably Russia.

-

Monday, December 22nd 2014 - 08:48 UTC

Oil price may slump to US$ 20... or then again maybe not

Market analysts describes two possible international scenarios. Whichever one prevails will be decisive. But it is not happenning soon.

-

Thursday, December 18th 2014 - 18:12 UTC

Oil price tumbles after OPEC releases 2015 forecast

The demand for oil in 2015 will drop to its lowest level since 2002 because of an oversupply of crude and stagnant economies in China and Europe, according to OPEC's latest forecast. And that's just one of several sour estimates.

-

Wednesday, December 3rd 2014 - 09:25 UTC

Russian ruble suffers its biggest one day skid since 1998

The Russian ruble suffered on Tuesday its biggest one-day decline since 1998 as oil prices continued to fall on Monday, escalating fears about the Russian economy. The currency slid almost 9% against the dollar before rallying after suspected central bank intervention.