MercoPress. South Atlantic News Agency

Tag: Paul Singer

-

Wednesday, August 20th 2014 - 10:00 UTC

Citi tells Griesa its banking license in Argentina is at risk because of the 'holdouts case'

Citigroup has told the US appeals court overseeing the dispute between Argentina and hedge funds refusing to accept terms of the country's debt restructuring that its Argentine banking license may be at risk as a result of the standoff.

-

Saturday, August 9th 2014 - 07:34 UTC

Griesa warns Argentina with 'contempt' if it continues with “false and deceiving statements”

New York district judge Thomas Griesa on Friday threatened to declare Argentina in “contempt” of court if the Republic continues to make “false and deceiving statements,” following Argentina’s claim it has already paid exchange bondholders and has no pending obligations, as it deposited 539 million dollars in bond payments in Bank of New York Mellon (BoNY) and Citibank.

-

Friday, August 8th 2014 - 08:57 UTC

Argentina urges Obama to intercede in holdouts case: Griesa is 'interfering with US foreign policy'

Argentine President Cristina Fernández on Thursday urged US President Barack Obama to intercede in the dispute between Argentina and holdouts over Argentine debt, while blasting New York judge Thomas Griesa for “not making any sense”.

-

Friday, August 8th 2014 - 08:49 UTC

The Guardian: How Barack Obama could end the Argentina debt crisis

By Greg Palast (*) - US president need only inform a federal judge that vulture fund billionaire Paul Singer is interfering with the president's sole authority to conduct foreign policy. He hasn't. But why not?

-

Sunday, August 3rd 2014 - 13:22 UTC

“Argentina Finds Relentless Foe in Paul Singer’s Hedge Fund”

The following article by Peter Eavis and Alexandra Stevenson was published in The New York Times and addresses the current litigation between Argentina and the speculative funds. The hedge fund firm of billionaire Paul E. Singer has about 300 employees, yet it has managed to force Argentina, a nation of 41 million people, into a position where it now has to contemplate a humbling surrender.

-

Friday, July 25th 2014 - 05:49 UTC

Holdouts lash out at Argentina: “it is choosing to default next week”

NML Capital Ltd, one of the lead holdout creditors in Argentina's sovereign bond dispute said on Thursday the Argentine government refused to negotiate through a mediator and was all but preparing to default on already restructured debt.

-

Wednesday, July 23rd 2014 - 06:42 UTC

Holdouts want to sit down with Argentina and solve the dispute; 'countdown clock'

Following on Tuesday's audience with Judge Thomas Griesa, NML Capital the leading speculative fund litigating with Argentina, issued a release saying “it is willing to hold a meeting with 'Special Master' Daniel Pollack and Argentina to solve the dispute”.

-

Friday, June 27th 2014 - 08:35 UTC

Judge Griesa calls Argentina and hedge funds for a hearing on Friday

A US judge has scheduled a hearing for Friday after hedge funds suing to collect on defaulted debt issued by Argentina complained about the country's plans to make a payment to creditors who participated in its past restructurings.

-

Monday, June 23rd 2014 - 04:27 UTC

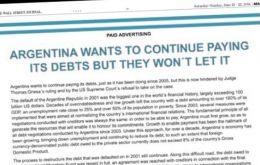

Argentina takes its differences with Judge Griesa to the US main journals

Argentina on Sunday took its battle against paying hedge fund investors in its defaulted bonds to the US media, placing adverts in major newspapers demanding US courts help foster “fair and balanced” negotiations.

-

Friday, June 20th 2014 - 07:21 UTC

After all: Argentina seems willing to start discussions with Griesa and hedge funds

After a day of fury and discussions with cabinet members, advisors and experts, Argentine president Cristina Fernandez will be sending a government delegation to New York to meet Judge Thomas Griesa and the hedge funds holdouts' solicitors and begin, hopefully, a round of negotiations to reach a settlement on the bonds litigation.