MercoPress. South Atlantic News Agency

Tag: Premier Oil plc

-

Friday, November 29th 2013 - 22:06 UTC

Falklands involved oil company expects to raise £100 million in bond offer

Premier Oil expects to raise at least £100 million in a bond offer scheduled to close on 6 December. The FTSE 250 oil and gas company, with interests in the Falkland Islands, the North Sea, and South-East Asia, said its 5% sterling bonds auction has already built a book value of at least £100 million.

-

Wednesday, November 27th 2013 - 07:07 UTC

Premier Oil with operations in the Falklands launches bond to diversify its debt away from banks

FTSE 250-listed energy explorer Premier Oil with strong interests in the Falkland Islands oil industry, launched this week a new bond, as it looks to diversify its debt away from banks.

-

Wednesday, October 16th 2013 - 00:33 UTC

Premier Oil, with Falklands’ interests buys into exploration project in Kenya

Premier Oil, which has a farm in agreement with Falkland Islands Rockhopper Exploration, is buying into an exploration project in Kenya, by farming into onshore Block 2B.

-

Thursday, October 3rd 2013 - 19:36 UTC

Falklands’ ‘FOGL and Desire Combination’ prepare to drill five wells next year

Falkland Oil & Gas is to buy a smaller Falklands-based firm to create a “combination” company with licences to search for oil both to the north and south of the Falkland Islands in the South Atlantic. FOGL said on Thursday it had agreed to buy Desire Petroleum offering 0.6 FOGL “consideration” shares for each Desire share, in a deal valuing Desire at 61 million pounds (99 million dollars).

-

Monday, September 2nd 2013 - 12:28 UTC

Falklands’ Argos considering drilling finance options and confident about new exploration round

Falkland Islands Argos Resources oil and exploration company have said that they are extremely well placed to participate in the next round of exploration drilling in the Falklands and they are continuing to consider various ways to finance drilling.

-

Saturday, August 31st 2013 - 00:44 UTC

Falklands’ first oil delayed as cost alternatives are considered

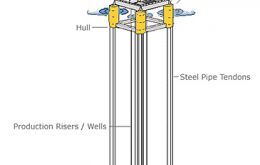

Premier Oil exploring for oil in the Falkland Islands said the company is studying cost alternatives to its drilling operations and crude extracting sub-sea architecture for the development of the Sea Lion project, which could delay the original chronogram for first oil.

-

Wednesday, July 31st 2013 - 05:35 UTC

Falklands' Sea Lion project outstands in Premier Oil exploration opportunities

Premier Oil, the British North Sea's oldest company outside the oil majors, is turning away from the region for future exploration opportunities such as the Catcher and the Sea Lion project in the Falkland Islands, according to a report published by Reuters.

-

Friday, July 5th 2013 - 06:58 UTC

Falklands’ on-shore storage for construction of oil flow lines to develop Sea Lion project

Bundled or reeled production flow lines could be constructed on-shore the Falkland Islands for Premier Oil, the UK independent company that is developing the Falklands Sea Lion project and expected to demand an investment of 5 billion dollars with first oil expected sometime in 2017.

-

Friday, July 5th 2013 - 06:52 UTC

Falklands assesses impact of hundreds of new jobs as it develops the oil and gas industry

A more permanent integrated type of immigration for the Falkland Islands is a strong message that has come out of a consultation with Falklands residents, in the preparation for a socio-economic study of oil and gas development in the South Atlantic British Overseas Territory.

-

Wednesday, July 3rd 2013 - 11:45 UTC

Rockhopper: High Court confirms the cancellation of the Company's Share Premium Account

Rockhopper Exploration plc (AIM: RKH), the North Falkland Basin oil and gas company, announces that at a hearing today, the Companies Court of the Chancery Division of the High Court of Justice confirmed the cancellation of the Company's share premium account (“Cancellation of Share Premium Account”). The Cancellation of the Share Premium Account is expected to become effective tomorrow, 4 July 2013.