MercoPress. South Atlantic News Agency

Tag: Uruguay

-

Friday, September 17th 2010 - 03:21 UTC

He had to borrow money for a bus ticket to collect a 2 million USD lottery prize

A Uruguay construction worker had to borrow the equivalent of seven US dollars from a neighbour to get to work. It was Thursday morning and several turned up to loan him the requested money.

-

Thursday, September 16th 2010 - 05:15 UTC

Uruguayan economy expands 9.8% in first half over last year

The Uruguayan economy continues to expand strongly having advanced 2.3% in the second quarter over the first quarter and 10.4% compared to a year ago and 9.8% over the fist half of 2009, according to the latest release from the Central Bank.

-

Thursday, September 16th 2010 - 05:06 UTC

USDA forecasts Uruguay’s beef exports will increase to 400.000 tons in 2011

Uruguay’s beef exports may rise by 2.6% next year as demand recovers from the global recession, according to a unit of the U.S. Department of Agriculture.

-

Saturday, September 11th 2010 - 18:39 UTC

Uruguay’s definitive iron-ore feasibility project to be completed by mid-2011

Swiss-based iron ore mining start-up Zamin Ferrous through its Brazilian affiliate is finishing the drilling stage of an iron-ore project in Valentines, Uruguay, and expects to complete its “definitive” feasibility study by mid-2011.

-

Tuesday, September 7th 2010 - 05:52 UTC

Uruguay announces re-purchase of 500 million USD of sovereign debt

The Uruguayan government announced that it authorized the repurchase of 500 million US dollars of sovereign debt with the purpose of optimizing its composition and the maturing timetable.

-

Tuesday, September 7th 2010 - 05:50 UTC

S&P raises Uruguay’s long term credit ratings to BB from BB-

Standard & Poor's Ratings Services raised its long-term foreign and local currency sovereign credit ratings on Uruguay to BB from BB- with a stable outlook thanks to the country's track record of sustained economic growth.

-

Monday, September 6th 2010 - 05:19 UTC

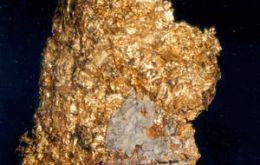

Canadian company impressed by first “gold values” prospecting in Uruguay

The Canadian company B2Gold announced “impressive gold values” from a systematic mechanical trenching program in the south of Uruguay where in association with a local company (Weeping Apple S.A.) it has an option to survey ten claims totalling 34.200 hectares.

-

Monday, September 6th 2010 - 04:20 UTC

A majority of Montevideo residents (71%) feel the city is not safe

A majority of Uruguay’s capital Montevideo residents (71%) feel the city is not safe and fear “mugging in the streets” and “young people consuming ‘pasta base’” (a cheap by-product of cocaine). They are also unsatisfied with the city’s transport system.

-

Tuesday, August 31st 2010 - 03:40 UTC

Uruguay government employees’ take-home pay doubles that of the private sector

Uruguayan government employees’ take-home pay on average more than doubles their counterparts in the private sector according to official figures from the country’s Social Security Office and published by Montevideo’s main daily El País.

-

Tuesday, August 31st 2010 - 03:12 UTC

Uruguayan soaring real estate values closely linked to depreciation of US dollar

Fears that Uruguay could be heading for a “real estate bubble” since prices in US dollars have increased more than 70% in the last five years, seem to have been neutralized by historic data and the strong appreciation of the Uruguayan currency.