MercoPress. South Atlantic News Agency

Tag: Argentine bondholders

-

Saturday, August 9th 2014 - 07:53 UTC

US reject the ICJ as an 'appropriate venue' for addressing Argentina's debt issues

A spokeswoman for the U.S. State Department said the United States would not permit the International Justice Court in The Hague to hear Argentina's claims that U.S. court decisions had violated its sovereignty.

-

Thursday, July 31st 2014 - 01:15 UTC

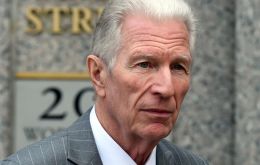

“Argentina will imminently be in default: no agreement was reached”, said Pollack

“Unfortunately no agreement was reached and Argentina will imminently be in default”, admitted Daniel A. Pollack, the Special Master appointed by Judge Thomas P. Griesa to conduct and preside over settlement negotiations between Argentina and its holdout bondholders. Pollack emphasized that with default “the ordinary Argentine citizen will be the real and ultimate victim”.

-

Tuesday, July 29th 2014 - 06:59 UTC

Pollack confirms meeting with Argentina on Tuesday, 24 hours before 'D' day

Argentina will sent a negotiation team to New York on Monday for further talks with a US court-appointed mediator Daniel Pollack in its debt dispute with “holdout” investors, Cabinet Chief Jorge Capitanich said earlier, with just two days left to avert a default.

-

Tuesday, July 22nd 2014 - 06:49 UTC

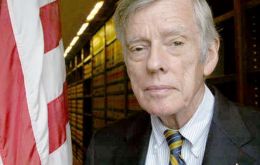

Argentina again requests stay ruling from Judge Griesa to pay restructured bondholders

Argentina asked U.S. judge Thomas Griesa on Monday to put on hold an order requiring it to pay bondholders who did not participate in debt restructurings following the country's 2002 default, while it seeks a “global resolution.”

-

Saturday, July 19th 2014 - 06:50 UTC

Italian chapter of holdouts tells Argentina it will continue to the last consequences

The Italian chapter of Task Force Argentina (TFA), an organization which represents bondholders that did not accept the 2005 and 2010 debt swaps, urged the government of President Cristina Fernandez to negotiate and warned it will keep on pursuing its interests until the last consequences.

-

Saturday, July 12th 2014 - 11:21 UTC

Holdouts claim the Argentine government refuses to negotiate with hedge funds

The holdout hedge fund Elliott Management Corp representative emerged on Friday from five hours of meetings in New York with a court-appointed mediator, claiming the Argentine government still refuses to have negotiation years after its historic default.

-

Tuesday, July 8th 2014 - 08:33 UTC

EU holders of restructured Argentine bonds begin court actions in Belgium

Holders of restructured Argentine bonds took to Belgian courts against Euroclear and the Bank of New York last week over their failure to pay out Argentina’s deposit, newspaper Tiempo Argentino (*) reported, citing court documents signed by the funds’ legal counsel.

-

Thursday, July 3rd 2014 - 06:57 UTC

US bank caught in bonds litigation requests guidance from Judge Griesa

The Bank of New York Mellon, fearful of being sued by Argentine bondholders and unwilling to defy a court order blocking their coupon payments, is seeking guidance from U.S. Judge Thomas Griesa on what to do with the money.

-

Wednesday, July 2nd 2014 - 07:53 UTC

“Vulture funds not interested in negotiations” claims Minister Kicillof

“Vulture funds are not interested in negotiations”, and all they want is “to get hold of the money for re-structured bonds holders”, said Argentina's Ministry of Economy in a release made public late Tuesday, the last exchange on the ongoing battle in a New York court with holdout hedge funds.

-

Saturday, June 28th 2014 - 10:57 UTC

Argentina claims Judge Griesa “blocked the payment to bondholders”

Through an official press release published on Friday afternoon, the Argentine government stated US Federal Judge, Thomas Griesa, attempted to “block the payment for bondholders,” and committed an abuse of authority, after cancelling the deposit made on Thursday into a Bank of New York account.