MercoPress. South Atlantic News Agency

Tag: Federal Reserve

-

Wednesday, May 2nd 2018 - 20:45 UTC

Fed leaves rates unchanged, confirms inflation near 2% target; hike expected at June meeting

The Federal Reserve on Wednesday left its benchmark interest rate unchanged, confirmed that inflation is near its 2% target, and strangely enough did not mention a word about the looming international trade confrontation. The central bank after a two-day meeting said inflation over the next 12 months should “run near” the 2% target, updating its language from March that indicated inflation would “move up” towards that level.

-

Thursday, March 22nd 2018 - 22:22 UTC

Bank of England leaves rates unchanged for now, waiting for more Brexit data

The Bank of England signaled on Thursday that it remains on course to lift interest rates in Britain this year and next, as figures showed a yearlong squeeze on consumers caused by a steep fall in the pound appears to be coming to an end.

-

Wednesday, March 21st 2018 - 20:25 UTC

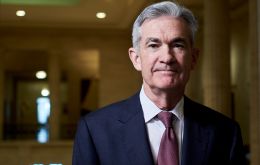

Powell's Fed confirms gradualism: anticipates 5 more modest rate increases in next 21 months

The Federal Reserve is raising its benchmark interest rate to reflect a solid U.S. economy and signaling that it's sticking with a gradual approach to rate hikes for 2018 under its new chairman, Jerome Powell. The Fed said it expects to increase rates twice more this year. At the same time, it increased its estimate for rate hikes in 2019 from two to three, reflecting an expectation of faster growth and lower unemployment.

-

Wednesday, February 28th 2018 - 09:53 UTC

Fed chairman Powell anticipates gradual interest rate increases despite larger government spending

Federal Reserve Chairman Jerome Powell, pledging to “strike a balance” between the risk of an overheating economy and the need to keep growth on track, told U.S. lawmakers on Tuesday that the central bank would stick with gradual interest rate increases despite the added stimulus of tax cuts and government spending.

-

Wednesday, February 7th 2018 - 15:23 UTC

Powell becomes chairman of the Fed in a turbulent trading day

Jerome Powell was sworn as the 16th chairman of the Federal Reserve on what turned out to be a turbulent day for Wall Street, with the Dow Jones industrial average plunging by more than 1,100 points. Powell, 65, was given the oath of office by Randal Quarles, the Fed's vice chairman for supervision, in a ceremony that took place before stock trading opened on Wall Street.

-

Thursday, December 14th 2017 - 13:54 UTC

Federal Reserve increases interest rate by a quarter of a point

The US Federal Reserve has increased interest rates by a quarter of a percentage point - the third rate hike this year. It comes as Fed chair Janet Yellen prepares to leave the role

after Donald Trump decided to replace her. -

Wednesday, November 29th 2017 - 08:10 UTC

Fed chief candidate anticipates US economy is ready to end “accommodation”

Jerome “Jay” Powell, President Donald Trump's pick to lead the US central bank, the Federal Reserve, is about to become “the most important economic policymaker in the world”. At least that's how one senator put it at Powell's confirmation hearing in Washington on Tuesday.

-

Saturday, November 11th 2017 - 09:07 UTC

Fed member anticipates rates likely to rise next month and three times in 2018

United States interest rates are likely to rise again next month and a further three times next year, one of the Federal Reserve's rate-setters has said. John Williams, who sits on the lliams, advanced a rate rise in December “makes sense, at least based on the information I have today”.

-

Thursday, November 2nd 2017 - 08:12 UTC

Trump expected to announce “centrist” Jerome Powell, as next head of the Fed

President Donald Trump has said he will announce on Thursday his choice to lead the seven/member Federal Reserve board beginning in February. Jerome Powell, a Fed board member, is assumed to be the top contender and Trump anticipated that “I think you will be extremely impressed by this person”.

-

Wednesday, October 18th 2017 - 08:24 UTC

The Fed started to reduce its US$4 trillion boost portfolio from the financial crisis

The Federal Reserve has started to run down some of the investments it made to boost the US economy after the financial crisis. The Fed holds a US$4.2trn portfolio of US Treasury bonds and mortgage-backed securities, and it will initially cut up to US$10bn each month from the amount it reinvests.