MercoPress. South Atlantic News Agency

Tag: Petrobras

-

Wednesday, November 12th 2014 - 06:48 UTC

US authorities looking into 'possible bribes' in the Petrobras corruption scandal

United States authorities are investigating whether Brazil's giant gas and oil corporation Petrobras or its employees were paid bribes, adding to the mounting domestic corruption probes facing the state-controlled oil company.

-

Friday, October 31st 2014 - 06:28 UTC

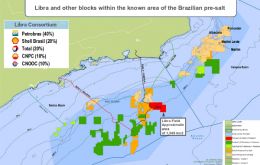

Petrobras consortium find high-quality oil at the Libra area, off Rio do Janeiro

The Petrobras-led Libra consortium has said that the first extension well in the Libra area, known as 3-BRSA-1255-RJS (3-RJS-731), has proven the discovery of high-quality oil in the northwest portion of the structure.

-

Monday, October 20th 2014 - 08:17 UTC

Dilma admits Petrobras funds were illegally diverted to finance political parties

Brazilian President and candidate for reelection Dilma Rousseff admitted that funds were illegally diverted at the state-run oil firm Petrobras, allegedly to benefit political parties allied with the government, and she promised to seek reimbursement of that money.

-

Wednesday, October 15th 2014 - 23:36 UTC

Brazil will rise fuel prices to help government managed debt-laden Petrobras

Brazil will maintain plans to raise domestic fuel prices this year, despite a sharp drop in international crude oil prices, to help debt-laden state-run oil company Petrobras, a government source said this week.

-

Wednesday, October 15th 2014 - 23:32 UTC

Petrobras sets a new oil and gas production record during September

Petrobras announced a new oil output record in Brazil, during September with an average of 2.23 million barrels of oil per day (bpd) production in the country, including in this total the fields operated by the state-owned company for its partners. The volume is 0.3% higher than breaks August record.

-

Saturday, October 4th 2014 - 10:38 UTC

Investors on edge waiting for the results of Sunday's voting in Brazil

Latin American currencies weakened on Friday after strong U.S. jobs data was seen as increasing the likelihood of higher interest rates in the world's largest economy, while Brazil markets fluttered in the last trading session before Oct. 5 elections.

-

Tuesday, September 30th 2014 - 04:40 UTC

Brazils' Bovespa and Real plunge as Dilma climbs in polls with less than a week to election

Brazilian financial markets took a beating on Monday after polls showed President Dilma Rousseff pulling past challenger Marina Silva ahead of Sunday's election. The Brazilian currency closed at its weakest level since December 2008 while the benchmark Bovespa stock index notched its biggest one-day loss in over three years.

-

Saturday, September 27th 2014 - 06:34 UTC

Marina Silva pledges to de-politicize regulatory agencies and state corporations

Brazilian presidential candidate Marina Silva vowed to de-politicize regulatory agencies that she says do more to win favor with government allies than ensure fair and efficient markets in Latin America's biggest economy.

-

Wednesday, September 17th 2014 - 04:02 UTC

Brazil will hold new round of oil right auctions in the first half of 2015

Brazil will hold a 13th round of oil rights auctions in the first half of next year in a sale that will include new areas in the country's promising Eastern Margin offshore region, a senior mines and energy ministry official said this week.

-

Monday, September 8th 2014 - 06:44 UTC

Petrobras corruption allegations smear Brazil's political system a month ahead of elections

A jailed former executive at state-controlled oil giant Petrobras Paulo Roberto Costa has reportedly implicated dozens of politicians from Brazil's leading political parties in a kickback scheme, a legal development that could shake up next month's general election.