MercoPress. South Atlantic News Agency

Economy

-

Thursday, April 10th 2014 - 06:28 UTC

Brazil's March inflation marks the steepest increase for the month since 2003

Brazil’s rate of inflation in March picked up at the quickest pace in 11 years for that month, challenging the central bank’s plan to stop raising interest rates soon and complicating President Dilma Rousseff chances of re-election.

-

Thursday, April 10th 2014 - 06:17 UTC

Argentine top minister in Washington attending the 'ideologically bias” IMF assembly

In a strong reply to the IMF report on the Argentine economy forecasting 0.5% expansion in 2014, the administration of President Cristina Fernandez said the multilateral organization suffers of an 'ideological bias' and its recipes only prompted the 'worst social and productive crisis in the history of Argentina'.

-

Thursday, April 10th 2014 - 05:56 UTC

Argentine unions anticipate massive support and turnout for Thursday's national strike

Argentina will witness on Thursday a new test of political clout and influence between the administration of Argentine president Cristina Fernandez and dissident organized labor, headed by teamster Hugo Moyano who has called for a national strike, anticipating it will have “a resounding massive support and turnout from the Argentine people”.

-

Thursday, April 10th 2014 - 05:37 UTC

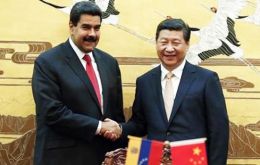

China has become Latam's banker loaning 102bn dollars from 2005 to 2013

China loaned 102 billion dollars to Latin America between 2005 and 2013, mainly to Venezuela and Argentina, while Mexico seems to be going the same way, according to a release from the Global Economic Governance Initiative which depends from the University of Boston.

-

Wednesday, April 9th 2014 - 19:44 UTC

Renewable energy keeps advancing despite a drop in overall investment

Renewable energy's share of world electricity generation continued its steady climb last year despite a 14% drop in investments to 214.4 billion dollars, according to a new report released on Monday and produced by the Frankfurt School-UNEP Collaborating Centre for Climate & Sustainable Energy Finance, the United Nations Environment Program (UNEP) and Bloomberg New Energy Finance.

-

Wednesday, April 9th 2014 - 07:29 UTC

IMF joins Argentine GDP linked bonds controversy involving potential payment of 3bn dollars

The International Monetary Fund reported on Monday a steep deceleration of Argentina’s economic activity for 2014, in a context of “high uncertainty”, according to its latest World Economic Outlook released in Washington.

-

Wednesday, April 9th 2014 - 06:52 UTC

Latest storms and rainy weather could cost Argentina 3 million tons of soybeans

Argentina's crop of soybeans and cereals, and the country's main source of hard currency is threatened by the last few days storms of pouring rainfall, flash floods and mud slides that have punished at least seven provinces. Argentina is one of the world's main suppliers of grains.

-

Wednesday, April 9th 2014 - 06:48 UTC

Osborne launches with Mantega Brazil/UK 'economic and financial dialogue'

Finance minister Guido Mantega and Chancellor of the Exchequer George Osborne announced on Tuesday in Sao Paulo the launching of the Brazil/UK Economic and Financial Dialogue to strengthen bilateral trade and cooperation, and investment in infrastrucutre, according to a joint release.

-

Wednesday, April 9th 2014 - 06:37 UTC

Chancellor welcomes insurer’s plans to boost Brazilian activity

Chancellor of the Exchequer George Osborne welcomed the decision by insurer Hiscox to join the Lloyd’s Brazil reinsurance platform during his current trip to Brazil. This will allow Hiscox to grow its Brazilian business, enabling it to talk directly to potential customers and better understand the local market.

-

Wednesday, April 9th 2014 - 06:30 UTC

Uruguay significantly stronger but still vulnerable to Argentina, says Fitch

While Uruguay's current financial position is significantly stronger than in the early 2000s when its economy suffered from the effects of the Argentine crisis, a severe downturn in Argentina could still have an important impact on Uruguay's economy through a variety of transmission channels, according to a new special report published by Fitch Ratings.