MercoPress. South Atlantic News Agency

Politics

-

Wednesday, November 5th 2014 - 21:37 UTC

HMS Argyll hosts Prince Charles and Colombian president Santos in Cartagena

The Prince of Wales and The Duchess of Cornwall, accompanied by the President of Colombia, Juan Manuel Santos and First Lady Maria Clemencia Rodriguez, visited Royal Navy frigate HMS Argyll alongside in Cartagena de Indias, Colombia on Friday, 31 October. The party were introduced to members of the ship’s company and witnessed an evening sunset ceremony.

-

Wednesday, November 5th 2014 - 21:09 UTC

Falklands' guardian HMS Clyde braves storms for routine South Georgia visit

Falkland Islands guardian HMS Clyde braved spring storms to pay her first visit of the Austral summer to the wildlife paradise of South Georgia. The patrol ship crossed 850 miles of ocean to reach the remote island – part of its domain as the Royal Navy’s permanent presence in the Falklands – to work with British Antarctic Survey scientists and generally fly the flag for the UK.

-

Wednesday, November 5th 2014 - 20:44 UTC

British and German embassies commemorate 100 years of the Battle of Coronel

British and German Embassies in Santiago organized a commemoration event to mark the 100 years of the Battle of Coronel, off the coast of Chile. A hundred years ago November first 1914, one of the first Naval battles of the First World War between the Royal Navy and the German Navy took place 50 miles off the coast of Coronel.

-

Wednesday, November 5th 2014 - 07:20 UTC

Cuba is asking for 8 billion dollars in investment from private corporations

Cuba asked international companies on Monday to invest more than 8 billion dollars in the island as it attempts to kick-start a centrally planned economy starved for cash and hamstrung by inefficiency.

-

Wednesday, November 5th 2014 - 07:05 UTC

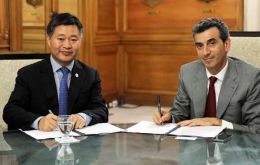

China rolling stock manufacturer to begin maintenance operations in Argentina

China’s rolling stock manufacturer China South Railway, CSR-Sifang will establish a presence in Argentina in a workshop currently ran by State-owned Trenes Argentinos Operadora Ferroviaria, Interior and Transport minister Florencio Randazzo announced on Tuesday.

-

Wednesday, November 5th 2014 - 06:43 UTC

The end of an era: Is the US petrodollar under threat?

Recent trade deals and high-level cooperation between Russia and China have set off alarm bells in the West as policymakers and oil and gas executives watch the balance of power in global energy markets shift to the East.

-

Wednesday, November 5th 2014 - 06:19 UTC

Falklands' 1914 German sunken battle ships to be explored by marine archeologist

Historian and renowned Marine Archaeologist, Mensun Bound, has been researching the events surrounding the December 2014 Battle of the Falklands and has secured private funding for a once in a life time expedition.

-

Wednesday, November 5th 2014 - 05:59 UTC

Republicans take control of the Senate: complicated last two years for Obama

The Republican Party has taken control of the Senate in the US mid-term elections, increasing their power in the final years of President Barack Obama's presidency. After gains in Arkansas, Montana, South Dakota, West Virginia and Colorado, North Carolina clinched victory. Kentucky's Mitch McConnell will become the Senate majority leader.

-

Wednesday, November 5th 2014 - 05:16 UTC

Chile chosen by World Bank for Latam’s first Research and Development Center

Chile’s Finance Ministry Alberto Arenas, and the World Bank Group (WBG), represented by its Vice President for Latin America and the Caribbean, Jorge Familiar, signed a cooperation agreement to establish in Chile the first Research and Development Center in Latin America, and the second outside Washington, DC.

-

Wednesday, November 5th 2014 - 04:30 UTC

US reply to Argentina: Soderberg's responsibilities as public servant not linked to bonds' dispute

The US Department of State has backed the appointment of Nancy Soderberg as Chair of the Public Interest Declassification Board (PIDB), saying her “responsibilities” as public servant are “not linked” with Argentina’s dispute with the holdouts, Argentina's Telam news agency reported.