MercoPress. South Atlantic News Agency

Tag: Aurelius Capital Management

-

Tuesday, July 22nd 2014 - 06:49 UTC

Argentina again requests stay ruling from Judge Griesa to pay restructured bondholders

Argentina asked U.S. judge Thomas Griesa on Monday to put on hold an order requiring it to pay bondholders who did not participate in debt restructurings following the country's 2002 default, while it seeks a “global resolution.”

-

Tuesday, July 15th 2014 - 07:07 UTC

Holdouts call on Argentina to settle debt payments and recall 30 July deadline

Aurelius Capital Management, one of the lead holdout creditors seeking to settle with Argentina over sovereign debt payments from its 2002 default, said on Monday the Argentine government faced a new crisis on July 30 unless it engages in real talks.

-

Saturday, July 12th 2014 - 11:21 UTC

Holdouts claim the Argentine government refuses to negotiate with hedge funds

The holdout hedge fund Elliott Management Corp representative emerged on Friday from five hours of meetings in New York with a court-appointed mediator, claiming the Argentine government still refuses to have negotiation years after its historic default.

-

Saturday, July 12th 2014 - 11:00 UTC

Pollack's hope is that dialogue between holdouts and Argentina will continue

Argentine officials and holdout investors met separately with the New York court-appointed mediator or 'Special Master' for five hours on Friday, presenting their cases in hopes of resolving a litigation on defaulted bonds that has dragged on for years.

-

Thursday, July 3rd 2014 - 06:57 UTC

US bank caught in bonds litigation requests guidance from Judge Griesa

The Bank of New York Mellon, fearful of being sued by Argentine bondholders and unwilling to defy a court order blocking their coupon payments, is seeking guidance from U.S. Judge Thomas Griesa on what to do with the money.

-

Monday, June 23rd 2014 - 04:27 UTC

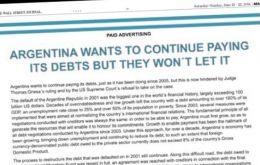

Argentina takes its differences with Judge Griesa to the US main journals

Argentina on Sunday took its battle against paying hedge fund investors in its defaulted bonds to the US media, placing adverts in major newspapers demanding US courts help foster “fair and balanced” negotiations.

-

Monday, June 23rd 2014 - 04:08 UTC

Jubilee Debt Campaign supports Argentina against “vulture funds” quick bucks

The following letter under the heading of “Urgent need for legislation on Argentina debt” was published in the Financial Times and refers to the ongoing battle with the holdout hedge funds.The piece is signed by Tim Jones, Policy Officer, Jubilee Debt Campaign, London, N1, UK.

-

Wednesday, June 4th 2014 - 07:43 UTC

Over 100 British MPs come out in support of Argentina and condemn 'vulture funds'

More than 100 British Members of Parliament have signed a resolution of support for Argentina in the fight against hedge fund holdout investors, and warned that if the United States Justice System ruled against the nation it could fall into default.

-

Saturday, May 31st 2014 - 06:50 UTC

Argentina tells Judge Griesa it has no plans to evade paying holdouts

Argentina's lawyers tried on Friday to assure a US federal judge that it would not evade orders to pay 1.33 billion dollars to bondholders who refused to accept its debt-restructuring offers, if the US Supreme Court (on 12 June) declines the case.

-

Friday, March 14th 2014 - 08:42 UTC

US will not side with Argentina in its dispute with hedge funds, says Kerry

US Secretary of State, John Kerry has rejected the possibility that the Barack Obama administration would side with Argentina in the long-standing dispute with hedge funds over the defaulted bonds from the 2001/2 meltdown. Still the US official praised what he considered some “positive steps” by the Cristina Fernandez government.