MercoPress. South Atlantic News Agency

Tag: investments

-

Monday, May 3rd 2010 - 03:09 UTC

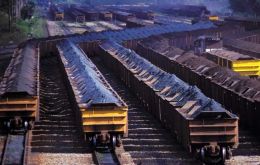

Norway Takes Over Aluminium Business and Bauxite Deposits in Brazil

Norway’s Norsk Hydro ASA (OSL: NHY), Europe’s third largest aluminum maker, agreed to buy mining and smelting assets from Vale (NYSE: VALE) in a deal valued at 4.9 billion US dollars, boosting its control over raw materials used in production.

-

Saturday, May 1st 2010 - 07:28 UTC

Euro Zone Leading Bank Praises Latam Growth and Financial System

Latin America currently has “the best financial system in the world”, said Francisco Luzón, member of the Board and head of the Latin American Division of Spain’s Banco Santander (NYSE:STD), the biggest bank by market capitalization in the Eurozone.

-

Friday, April 30th 2010 - 05:54 UTC

Uruguay’s Fray Bentos Pulp Mill Boosts Profits of Finland’s UPM

Finland’s pulp and paper manufacturer UPM's (OMX: UPM1V) Fray Bentos unit in Uruguay proved overwhelmingly the most profitable, helping to boost an otherwise first quarter profit of the year which was described as “unsatisfactory” by CEO Jussi Pesonen.

-

Friday, April 30th 2010 - 02:49 UTC

LAN Plans to Invest 2.83 Billion USD in 2010/2013 to Expand its Fleet

LAN (NYSE: LFL), Chile's dominant airline and flag carrier, announced Thursday it would invest 2.83 billion US dollars between 2010 and 2013 to expand its fleet. CEO Jorge Awad told a shareholder meeting the company would invest 500 million USD in 2010 and 1 billion USD in 2011 to purchase both short and long-haul aircraft.

-

Friday, April 30th 2010 - 01:16 UTC

Repsol YPF Plans to Raise Cash to Keep Expanding in Brazil

Repsol YPF S.A. (BMAD:REP), Spain’s biggest oil company, is considering the sale of about 40% of its Brazil assets in an initial public offering as early as this year, company executives said Thursday on a conference call.

-

Wednesday, April 28th 2010 - 06:29 UTC

Banks Serving Rich Argentines Moving from Bs. As. to Miami and Montevideo

More than ten investment banks, including Wells Fargo, HSBC, Merrill Lynch and Credit Suisse, will leave Argentina in the coming weeks, a Buenos Aires newspaper reported Monday.

-

Tuesday, April 27th 2010 - 21:40 UTC

Canadian Fund Invests in Uruguay’s Flagship Carrier PLUNA

Jazz Air Income Fund has agreed to invest 15 million US dollars for an indirect stake in Uruguay's flagship carrier, Pluna. The fund behind Air Canada's regional affiliate, Jazz Air, said that it will get a one-third, non-voting interest in Latin American Regional Aviation Holding Corp., which owns 75% of Pluna Lineas Aireas Uruguayas. The remaining 25% of Pluna is held by the government of Uruguay.

-

Friday, April 23rd 2010 - 03:21 UTC

Brazil forecasted to grow 5.5% in 2010 boosted by domestic demand, says IMF

Brazil, Latinamerica’s largest economy and leading Mercosur partner is poised to grow 5.5% this year, almost a whole percentage point more than the previous forecast in January, according to the International Monetary Fund “World Economic Outlook” released in anticipation of the IMF and World Bank annual assembly this weekend in Washington.

-

Friday, April 23rd 2010 - 01:40 UTC

Chile’s nationalized copper company taps private sector CEO

Chile’s nationalized copper company—and the largest copper company in the world—has a new CEO. Diego Hernández Cabrera, a current executive with International mining giant BHP Billiton, was appointed unanimously this week as CEO by Codelco’s board of executives.

-

Thursday, August 24th 2006 - 21:00 UTC

Cellulose Prices at their Highest in Five Years

Chilean wood pulp producers Copec and CMPC are cashing in on high cellulose prices, which rose to a year-to-date high of 708.7 US dollars a ton on Tuesday. This is the highest price for cellulose since 2002, the disastrous year when cellulose prices fell to 433.2 US dollars a ton.