MercoPress. South Atlantic News Agency

Tag: oil production

-

Saturday, November 24th 2018 - 08:59 UTC

Oil price slumps 8% to lowest in more than a year: Crude supply grows faster than demand

Oil prices slumped up to nearly 8% to the lowest in more than a year on Friday, posting the seventh consecutive weekly loss, amid intensifying fears of a supply glut even as major producers consider cutting output. Oil supply, led by U.S. producers, is growing faster than demand and to prevent a build-up of unused fuel such as the one that emerged in 2015, the Organization of the Petroleum Exporting Countries is expected to start trimming output after a meeting on Dec. 6.

-

Tuesday, October 30th 2018 - 08:45 UTC

YPF plans US$ 4bn annual investment in oil and gas production

Argentina's state-controlled oil company, YPF, will significantly boost oil and gas production, investing between US$4 and US$ 5 billion per year through 2022, Chief Executive Daniel Gonzalez said. The plan is to raise production by between 5and 7% per year, with the largest increase in the Vaca Muerta formation, one of the world's largest reserves of shale oil and gas.

-

Friday, September 28th 2018 - 08:47 UTC

Oil majors to bid for Brazil's offshore potential despite electoral uncertainty

Oil majors are set to gather in Rio de Janeiro this Friday to unveil bids for stakes in Brazil’s high potential offshore areas ahead of elections that are casting a cloud of uncertainty over the industry.

-

Tuesday, September 25th 2018 - 08:37 UTC

Argentina plans offshore licensing round in the South Atlantic next October

Argentina plans to launch a delayed offshore licensing round in October as it seeks to explore a large frontier region in the South Atlantic for potential oil and natural gas production growth in the future. This was announced to oil executives in Houston by Argentina's energy secretary Javier Iguacel.

-

Monday, September 24th 2018 - 09:15 UTC

Petrobras plans to increase output 10% next year to some 2.3 million bpd

Brazil’s state-run oil giant Petrobras aims to raise output as much as 10% to around 2.3 million barrels per day (bpd) in 2019 and cut net debt by US$10 billion, according to Chief Financial Officer Rafael Grisolia. The world’s most indebted oil company is on course to reduce debt to US$ 69 billion by the end of this year despite falling short of its US$ 21 billion asset sales target, Grisolia pointed out.

-

Wednesday, September 19th 2018 - 08:11 UTC

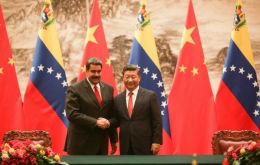

China agreed to invest US$ 5bn in Venezuelan oil, alleges Maduro

Venezuelan President Nicolas Maduro said on Tuesday that new investments from China will help his country dramatically boost its oil production, doubling down on financing from the Asian nation to turn around its crashing economy.

-

Saturday, July 14th 2018 - 19:53 UTC

Corruption unleashed: Venezuelan government denounced for enriching itself with aid funds

According to a financial intelligence panel that met Friday in Cartagena, Colombia; in Venezuela, Maduro's government “uses food and humanitarian aid as a weapon for social control.”

-

Saturday, July 14th 2018 - 07:48 UTC

Venezuela’s oil crisis gets worse: Production keeps falling

Venezuela’s oil production plunged by another 47,500 barrels per day (bpd) in June, compared to a month earlier. An exodus of workers and field shut downs were reported for the month, pointing to a grim near-term future that could see total production dip below 1 million barrels per day (mb/d) by the end of the year.

-

Monday, July 2nd 2018 - 08:25 UTC

Saudi Arabia prepared to help with Trump's request “to pump more oil”, but gives no specifics

President Donald Trump said over the weekend that he had received assurances from King Salman of Saudi Arabia that the kingdom will increase oil production, “maybe up to 2,000,000 barrels” in response to turmoil in Iran and Venezuela. Saudi Arabia acknowledged the call took place, but mentioned no production targets.

-

Tuesday, June 26th 2018 - 09:06 UTC

Petrobras agrees to pay US$ 3bn in reparations to US investors

Brazilian state oil company Petrobras announced Monday that it would pay almost 3 billion U.S. dollars in reparations to U.S. investors who were harmed by the corruption ring within the firm. Brazil's largest company was sued in a class action lawsuit, which was approved on June 22 by a federal court in New York.