MercoPress. South Atlantic News Agency

Tag: Yuan

-

Tuesday, May 16th 2017 - 10:34 UTC

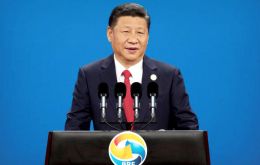

China convenes 29 world leaders to launch its Silk Road plan to forge peace and free trade

Chinese President Xi Jinping pledged US$124 billion for his ambitious new Silk Road plan to forge a path of peace, inclusiveness and free trade, and called for the abandonment of old models based on rivalry and diplomatic power games.

-

Monday, October 3rd 2016 - 07:54 UTC

Yuan becomes global reserve currency but China will have to relax capital controls and the exchange rate

The Chinese currency Yuan entered a new phase in its journey to become more important to the world economy: starting on Saturday the Yuan is officially a member of the International Monetary Fund’s basket of global reserve currencies. Together, this group of currencies, known as Special Drawing Rights (SDR), forms a kind of pseudo-currency—used only by the IMF—to supplement countries’ official reserves.

-

Monday, February 15th 2016 - 07:20 UTC

With Chinese New Year over, central bank reaffirms strong Yuan policy

Chinese central bank governor Zhou Xiaochuan has accused “speculative forces” of targeting the country's currency, the Yuan, and argued there was no reason for the Yuan to keep depreciating in value and that China would not let international speculators dominate market sentiment.

-

Tuesday, December 1st 2015 - 07:53 UTC

Yuan joins the exclusive club of IMF's basket of reserve currencies

The International Monetary Fund (IMF) has announced that China's currency, the Yuan, will join the fund's basket of reserve currencies. Currently just the US dollar, the euro, the yen and the pound are in the group.

-

Monday, November 23rd 2015 - 10:42 UTC

Unfair to claim China sparked a 'currency war', argues India's central bank

”It’s unfair to pin the blame on the August 11 Yuan devaluation because currencies were already declining due to the “unconventional monetary policies” of some nations, Raghuram Rajan was cited as saying in an interview with the SCMP.

-

Monday, November 23rd 2015 - 09:39 UTC

China's Yuan to be included in IMF's SDR basket of currencies

The inclusion of the Chinese currency in the International Monetary Fund's special drawing rights (SDR) basket is long awaited, long overdue and, finally, all but a foregone conclusion.

-

Wednesday, September 9th 2015 - 07:45 UTC

World Bank calls on the Fed to delay raising rates fearing 'panic and turmoil' in emerging markets

The international economics establishment has stepped up pressure on the Federal Reserve to delay raising interest rates, with the World Bank the latest institution to warn that the US central bank risks sparking “panic and turmoil” in emerging markets if it increases rates next week.

-

Wednesday, August 26th 2015 - 07:10 UTC

Chinese stocks refuse to bounce back; Shanghai Composite dropped 16% this week

Chinese shares continued to lose ground despite the central bank's latest effort to reassure traders. The mainland's benchmark Shanghai Composite was down 1.1% to 2,930.23 points after a volatile open earlier. The index had already fallen about 16% this week, sending shockwaves through global markets.

-

Saturday, August 22nd 2015 - 08:16 UTC

World markets plunge on fears of a China-led global slowdown

The S&P 500 suffered its biggest daily percentage drop in nearly four years and the Dow confirmed it had entered into correction territory as fears of a China-led global slowdown rattled investors around the world.

-

Friday, August 21st 2015 - 06:34 UTC

Shanghai Composite's 'virus' reaches Western markets

Asian stocks saw sharp falls on Friday as mounting concerns over China's slowing economy continued to affect global markets. It follows big falls in US and European markets on Thursday, with the Dow Jones dropping more than 2%.