MercoPress. South Atlantic News Agency

Tag: Axel Kicillof

-

Monday, September 15th 2014 - 06:23 UTC

Argentina confirms payment to bondholders at the end of September

Argentina will pay holders of its restructured sovereign debt, thanks to a bill passed by its Congress last week despite a US court ruling, the country's economy minister told a local radio show on Sunday.

-

Wednesday, September 10th 2014 - 06:03 UTC

World Bank commits 5bn dollars financial support for Argentina in 2015/2018

The World Bank Group’s (WBG) Executive Directors discussed a new Country Partnership Strategy (CPS) for Argentina covering fiscal years 2015-2018 with financial commitments over the period expected to be in the range of 1 to 1.2 billion dollars per year plus 1.7bn for the private sector.

-

Thursday, September 4th 2014 - 05:20 UTC

Argentina's dispute with holdouts “will not affect” Chinese investments, says Beijing

The current legal dispute between Argentina and holdouts (“vulture funds”) suing the country over its defaulted bonds “will not affect” planned Chinese investments, since Argentina and China have a 'strategic association', the head of the National Commission of Development and Reform (CNDR) of China Xu Shaoshi, warned on Wednesday.

-

Wednesday, September 3rd 2014 - 06:37 UTC

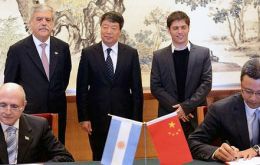

Kicillof in China to confirm loans and a much needed swap dollars

Credit strapped Argentina is wooing Beijing and with this purpose Economy Minister Axel Kicillof, Planning Minister Julio De Vido and YPF oil company CEO Miguel Galuccio are currently on an official trip to China, aimed at gathering funding for public works including two dams and one nuclear power plant.

-

Saturday, August 30th 2014 - 08:01 UTC

Judge Griesa schedules new hearing; Argentina appeals to United Nations on holdout case

The US judge overseeing litigation by Argentina and creditors who did not participate in the country's past debt restructurings scheduled a hearing to assess whether Citigroup Inc (C.N) should be forced to comply with a subpoena.

-

Friday, August 29th 2014 - 06:46 UTC

Mercosur main partners in another attempt to re-launch withering economies

Argentine Economy minister Axel Kicillof left Buenos Aires on Thursday for Brazil, where he will meet with fellow ministers from the country to discuss the current situation of bilateral trade and the automotive industry.

-

Friday, August 29th 2014 - 05:56 UTC

Argentina will only negotiate with all bondholders: no more piecemeal debt talks

Argentina's government ruled out further piecemeal debt talks with a small group of U.S. hedge funds (holdouts) and said the country needed to strike a deal with all bondholders including those which have rejected past restructuring agreements as a single group.

-

Wednesday, August 27th 2014 - 06:07 UTC

As confidence vanishes, US dollar in Argentina breaks new record: 14.20 Pesos

Despite appeals to national unity from president Cristina Fernandez, the US dollar, Argentina's best test for confidence, climbed 22 cents to a new record in the informal market at the end of Tuesday's trading: 14.20 Pesos.

-

Friday, August 22nd 2014 - 07:43 UTC

Argentina describes Griesa as 'ignorant' and lacking knowledge on democratic institutions

The Argentine government again blasted Judge Thomas Griesa for declaring 'illegal' the bill sent to Congress referred to the country's debt and creditors, and said the magistrate “ignores national sovereignty” and “ignores how democratic institutions function”.

-

Friday, August 22nd 2014 - 07:33 UTC

European holders of swapped Argentine bonds willing to accept removal of the RUFO clause

European investors holding 5.2 billion dollars of restructured Argentine bonds are negotiating the removal of the Rights Upon Future Options (RUFO) clause that Argentina claims prevents them from negotiating with holdout funds, it was reported in the Buenos Aires media.