MercoPress. South Atlantic News Agency

Tag: Axel Kicillof

-

Friday, August 22nd 2014 - 07:17 UTC

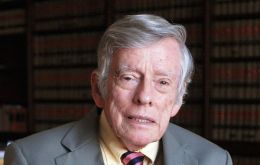

Griesa leaves Argentina 'in contempt' ledge; warns any change of jurisdiction was 'lawless'

US District Judge Thomas Griesa declared on Thursday that an Argentine plan to change the 'jurisdiction' of restructured foreign debt was illegal, while resisting holdout investors' demands that Argentina be held in contempt of court for attempting to change the site of payment to Buenos Aires.

-

Thursday, August 21st 2014 - 08:30 UTC

Kicillof: “no change of NY jurisdiction, but a change of payment location”

Argentina's new plan to skirt U.S. courts and resume payment on defaulted bonds aims to protect creditors who participated in two debt restructurings, Economy minister Axel Kicillof said on Wednesday. But he also emphasized that the bill sent to Congress did not mean a 'change of jurisdiction' from New York but rather a change of payment 'location'.

-

Thursday, August 21st 2014 - 07:07 UTC

Aurelius Capital brands Argentine leaders 'outlaws' for flouting US courts orders

One of two hedge funds that sued Argentina over defaulted bonds branded the country's leaders “outlaws” on Wednesday after Buenos Aires moved to shift its bond payment method.

-

Wednesday, August 20th 2014 - 09:22 UTC

Nervous Cristina skirts New York court and pledges to service swapped bonds in Argentina

President Cristina Fernandez said on Tuesday her government will move to service its defaulted debt in Argentina or allow bondholders to swap their bonds for new bonds governed by national law in order to get around a U.S. court order.

-

Thursday, August 14th 2014 - 06:11 UTC

Argentina: US dollar reaches a new record of 13.15 Pesos in Buenos Aires 'blue' market

The US dollars climbed to a record 13.15 Pesos on the black or 'blue' market on Wednesday trading as fears mount regarding the outcome of the holdout bonds conflict with the New York court. The official dollar rate closed at 8.2750 Pesos.

-

Saturday, August 9th 2014 - 07:45 UTC

Despite warning, Kicillof again defies and again accuses Griesa of 'partiality'

Economy ministry Axel Kicillof once again defiantly insisted Argentina has made a required debt payment on restructured sovereign bonds on Friday night, just hours after a U.S. judge threatened a contempt-of-court order if Argentina did not stop issuing such statements.

-

Friday, August 8th 2014 - 09:07 UTC

Argentina announces measures to prop the economy and avoid redundancies

A day after Economy minister Axel Kicillof admitted problems with the Argentine economy, president Cristina Fernandez announced on Thursday a battery of measures to prop economic activity, open the labor market for young people, avoid redundancies and give the property market a thrust.

-

Thursday, August 7th 2014 - 07:02 UTC

Argentina closer to contempt of court as it suggests bondholders to change paymaster

New York district judge Thomas Griesa and the Argentine government are again on the collision course: while the magistrate has ordered the Bank of New York Mellon to retain the funds deposited by Argentina to pay exchange bondholders and declaring the payment “illegal”, the Ministry of Economy in Buenos Aires suggested bondholder should change BONY for a new intermediary institution.

-

Wednesday, August 6th 2014 - 08:02 UTC

Argentina will demand Citibank and BONY to pay exchange bondholders

The Argentine Government will formally demand that Citibank and the Bank of New York Mellon pay exchange bondholders, the Economy Ministry informed on Tuesday in a press release.

-

Sunday, August 3rd 2014 - 13:22 UTC

“Argentina Finds Relentless Foe in Paul Singer’s Hedge Fund”

The following article by Peter Eavis and Alexandra Stevenson was published in The New York Times and addresses the current litigation between Argentina and the speculative funds. The hedge fund firm of billionaire Paul E. Singer has about 300 employees, yet it has managed to force Argentina, a nation of 41 million people, into a position where it now has to contemplate a humbling surrender.