MercoPress. South Atlantic News Agency

Tag: sea lion well

-

Thursday, September 20th 2018 - 06:52 UTC

Falklands Sea Lion development on track to begin offshore operations

Negotiations continue with service providers for the Premier Oil-operated Sea Lion development in the offshore North Falkland basin. According to partner Rockhopper Exploration, Phase 1 will develop around 220 MMbbl in license PL032 and a further 300 MMbbl from the license’s remaining resources under Phase 2.

-

Monday, August 28th 2017 - 07:52 UTC

Falklands: Premier Oil is asking for export funds to develop Sea Lion, reports Financial Times

The Financial Times is reporting that Premier Oil is negotiating with the UK government about securing export finance to fund just over half of the US$1.5bn investment needed to develop a large oilfield in waters north of the Falkland Islands. If all works out as planned first oil in the Falklands would be in 2021.

-

Wednesday, February 8th 2017 - 10:17 UTC

Falklands' oil exploration: Rockhopper announces investments in Sea Lion

Rockhopper Exploration plc has provided its latest operational and corporate update which includes the North Falkland Basin Sea Lion project and has announced that the technical engineering is approaching conclusion and a settlement on the Eirik Raude rig dispute has been reached.

-

Thursday, February 18th 2016 - 06:19 UTC

Falklands' oil industry continues to advance, despite current low prices

Despite current low oil prices, the oil and gas industry in the Falkland Islands is continuing to go from strength to strength as its first project, Premier Oil’s Sea Lion, moves closer to commercialization, according to an analyst with research and consulting firm GlobalData.

-

Friday, February 27th 2015 - 05:29 UTC

Falklands oil rig arrives and readies to begin six-well drilling campaign

The semi-submersible oil rig oil rig Eirik Raude entered Falkland Islands waters to the north this week and has already been served by supply vessels and undergone a crew change operation. The Eirik Raude will shortly begin a six-well drilling campaign operated by Premier Oil and Noble Energy.

-

Tuesday, April 8th 2014 - 22:05 UTC

Falklands fiscal regime and stability remain attractive for oil and gas industry

With the Falkland Islands' upstream oil and gas industry still in its infancy, the country's attractive fiscal regime, which boasts a low government take, is expected to remain stable through the short and medium term, says a new report from research and consulting firm GlobalData.

-

Thursday, October 3rd 2013 - 19:36 UTC

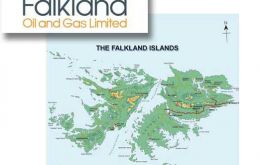

Falklands’ ‘FOGL and Desire Combination’ prepare to drill five wells next year

Falkland Oil & Gas is to buy a smaller Falklands-based firm to create a “combination” company with licences to search for oil both to the north and south of the Falkland Islands in the South Atlantic. FOGL said on Thursday it had agreed to buy Desire Petroleum offering 0.6 FOGL “consideration” shares for each Desire share, in a deal valuing Desire at 61 million pounds (99 million dollars).

-

Wednesday, July 31st 2013 - 05:35 UTC

Falklands' Sea Lion project outstands in Premier Oil exploration opportunities

Premier Oil, the British North Sea's oldest company outside the oil majors, is turning away from the region for future exploration opportunities such as the Catcher and the Sea Lion project in the Falkland Islands, according to a report published by Reuters.

-

Friday, April 19th 2013 - 06:32 UTC

Falkland Islands Holdings expects a quantum leap in the local economy over the next decade

Falkland Islands Holdings, which owns the Falkland Islands Company, FIC, expects to report a slight fall in annual profits but anticipates a quantum leap in the Falklands’ economy over the next decade with the oil industry and the commencement in 2014 of the Sea Lion project.

-

Wednesday, January 9th 2013 - 16:50 UTC

Argos Resources storms ahead of its Falklands’ oil drilling rivals

Argos Resources the only Falklands explorer to not drill a well has had the most successful year of them all in share price terms. Results of interpretation of 3D seismic data are encouraging with a number of prospects identified and the company is looking for industry partners to take exploration drilling forward. Year to date share price performance: up 107.92% at 24.95p.