MercoPress. South Atlantic News Agency

Tag: Mauricio Macri

-

Thursday, September 27th 2018 - 09:19 UTC

Argentine Peso with trading band and zero growth monetary supply policy

The International Monetary Fund Managing Director Christine Lagarde, speaking at a news conference in New York alongside Argentine Economy Minister Nicolas Dujovne, said IMF was “significantly frontloading” disbursements under the program adding the Argentine central bank had agreed as part of the deal to allow the peso currency to float freely and would only intervene in the foreign exchange market in extreme circumstances.

-

Thursday, September 27th 2018 - 05:45 UTC

IMF and Argentina concord on 36-month US$ 57bn stand-by agreement

The International Monetary Fund staff and Argentina authorities have reached an agreement on a set of strengthened economic policies that will underpin the 36-month Stand-By Arrangement (SBA) approved on June 20, 2018.

-

Wednesday, September 26th 2018 - 09:09 UTC

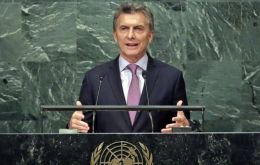

Macri at UN reaffirms Argentine sovereignty over Falklands, but also praises positive dialogue with UK

President Mauricio Macri reaffirmed, once again, “Argentina's legitimate and imprescriptible sovereign rights over the Malvinas, South Georgia and South Sandwich Islands and their surrounding maritime spaces”, in his speech to the United Nations General Assembly on Tuesday.

-

Tuesday, September 25th 2018 - 21:35 UTC

Who is Guido Sandleris, Argentina's Central Bank president after the surprise resignation of Caputo

The resignation of Luis Caputo to the Presidency of the Central Bank of Argentina (BCRA), which has been reflected with surprise by the international media, occurs amid the trip of the Argentine President, Mauricio Macri, to New York to attend the Assembly General of the UN and with the mission of restoring the confidence of the international market in the Argentine economy. His predecessor, Guido Sandleris, receives a Central Bank when it is about to close an agreement with the International Monetary Fund (IMF).

-

Tuesday, September 25th 2018 - 19:04 UTC

Argentine Central bank governor resigns for personal reasons: Peso slides 5% against the US dollar

The governor of Argentina's central bank, Luis Caputo resigned on Tuesday for personal reasons, the bank said in a statement, a surprise announcement in the midst of the country's talks with the IMF that sent the peso tumbling. Former finance minister Caputo has only held the role since June and is the second Argentine central bank president to resign this year. Argentina's peso currency slid 4.65% to open at 39.15 per U.S. dollar after the announcement, traders said.

-

Tuesday, September 25th 2018 - 06:59 UTC

“Zero chance” Argentina will default on its debt next year, Macri tells bankers and investors

President Mauricio Macri said on Monday that Argentina was close to a deal with the International Monetary Fund to bolster a US$ 50 billion credit line, while a government source said US$ 3-US$ 5 billion in additional funds could be announced this week.

-

Tuesday, September 25th 2018 - 06:51 UTC

Macri announced in New York that he will run for reelection next year

Argentine president Mauricio Macri said on Tuesday in New York addressing a meeting with potential investors that he was prepared to run for reelection next year, and that there will be no change of course, “there is no plan B”.

-

Monday, September 24th 2018 - 09:19 UTC

Macri in New York to convince investors Argentina in on track to stability and address the UN assembly

Argentine president Mauricio Macri is in New York where he is scheduled to address the United Nations General Assembly on Tuesday, but will also be holding a round of talks with business leaders and potential investors, plus granting interviews to key media outlets.

-

Saturday, September 22nd 2018 - 08:53 UTC

Argentine Peso strengthened for the third straight day on Friday

Argentina’s peso strengthened for the third straight day on Friday, driven by optimism that the government would sign a revised financing deal with the International Monetary Fund to include stricter fiscal measures and faster cash disbursements.

-

Saturday, September 22nd 2018 - 08:30 UTC

Argentina ready to launch a satellite to monitor natural disasters and soil moisture

Argentina is launching a new microwave imaging satellite to monitor natural disasters and soil moisture, in a long-term bid to bolster the farm sector, an industry that has historically been the backbone of the country’s economy.